Understanding Land Valuation Models Helps Landowners Maximize Their Investment Returns

The valuation of raw land presents unique challenges and opportunities. Many factors influence a property’s highest and best use and contribute to the determination of the property’s market value. Location, size, physical condition, access to utilities, and zoning are five among many factors incorporated into a rational market valuation analysis.

Landowners are well advised to understand the methods used to determine property valuations. Clear insight can be leveraged to maximize their investment returns.

Two Models Frequently Used to Evaluate Raw Land

There are several methods used to determine the market value of raw land. The two most widely used are the Comparative Property Method (COMP Method) and the Residual Land Valuation Method (RLV Method).

The COMP Method compares the subject property to similar, recently sold properties. The real estate analyst identifies similar recent sales, then compares the recent sales to the subject property. Several characteristics are assessed – including location, condition, utility access, transportation infrastructure, market velocity, absorption, and current zoning. Subjective pricing adjustments are made to incorporate the characteristics that are informed by recent sales of similar properties.

In our view, the COMP Method alone does not provide an accurate measure of valuation in volatile markets. COMPs are a lagging indicator of value, and the approach is particularly ineffective today.

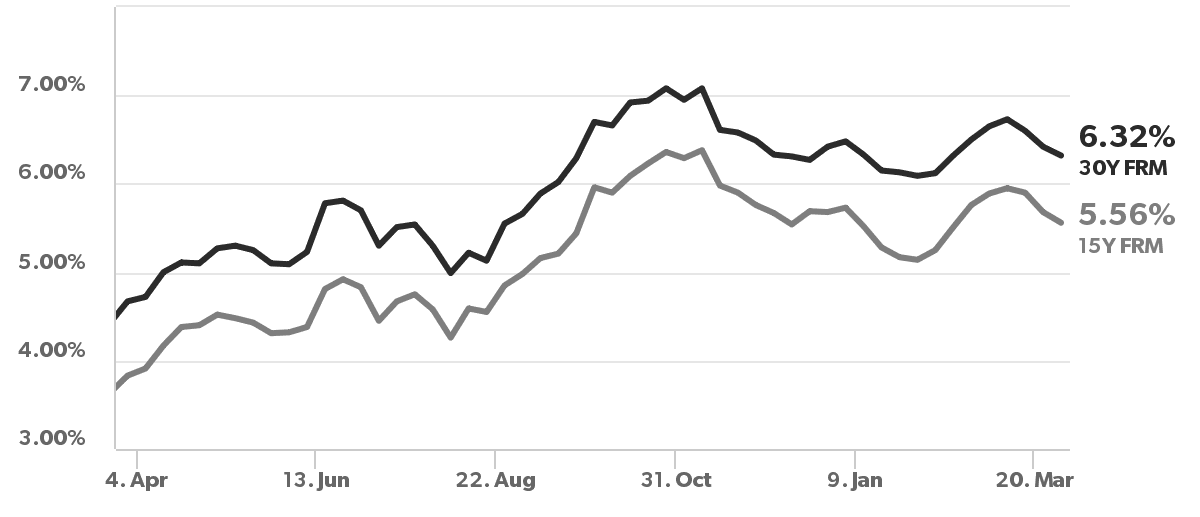

In our experience (which dates from 1987 and exceeds $2 billion in transactions) comparative property values are determined 6 – 12 months prior to closing escrow. 12 months ago, 30-year fixed home mortgages were 3.3%. Today they are approaching 7%.

Mortgage Intertest Rates, Apr. 2022 – Apr. 2023

Source: Freddie Mac

Increasing interest rates have caused material declines in new home sales. New home sales drive residential land demand. Today the economic landscape is considerably different than it was 6 months ago. Landowners selling property now should not anticipate a market value similar to the values established 6 months ago, or last year.

The Residual Land Valuation (RLV Method) is more commonly used by land developers, home builders, and appraisers. In contrast to the COMP Method, the RLV Method is quantitative and based on a simple formula:

Land Value = Total Revenue minus Construction & Development Costs

Developers estimate the total revenue the property can generate. First, they analyze market conditions and product types to determine the total revenue potential of a fully developed property. Then they subtract construction costs, including hard costs such as materials and labor, and soft costs such as insurance, marketing, and financing fees. Next, they subtract the land development costs. Land development costs include items such as civil engineering, utility connection fees, street lighting, landscaping, etc.

The amount of money remaining after construction and development costs are subtracted from the total revenue potential determines the amount of money the developer will pay for the raw land.

Conclusion

Home prices, construction costs, and land development costs are established by the market. In the present market, home purchasing has slowed because of interest rate increases. Home pricing has declined in response. However, ongoing supply chain and labor issues are causing construction costs to remain higher than their pre-COVID rates. Taken together, these conditions have adversely impacted the amount of money developers will pay for raw land in the present market.

As residential land specialists with 35 years of experience, we have sold more than $2 billion in land. Our objective is to assist clients by selling their properties at the highest possible prices given the present market conditions. This is the reason we employ the Residual Land Valuation Method to help guide our clients’ investment decisions.