What is a Broker Price Opinion?

Why do you need one now?

A Broker Price Opinion (BPO) is an estimate of a property’s market value. A BPO must be developed by a licensed real estate broker to be legally compliant. A Broker Price Opinion differs from an appraisal. A BPO is best suited to estimate the likely sales price, determine a property’s listing price, and may include a marketing plan. An appraisal is used to obtain financing and can only be prepared by a licensed appraiser.

BPOs are based on the professional acumen of the broker assessing the property, and they are inherently subjective. Consequently, the experience of the broker preparing the BPO is an important consideration for a property owner. By comparison, a high-volume broker that handles a sales volume of over $100 million annually across 50 transactions is more qualified than an agent that does less. Opinions vary in content, substance, and length. A comprehensive BPO provides the analytical framework to determine a property’s true market value.

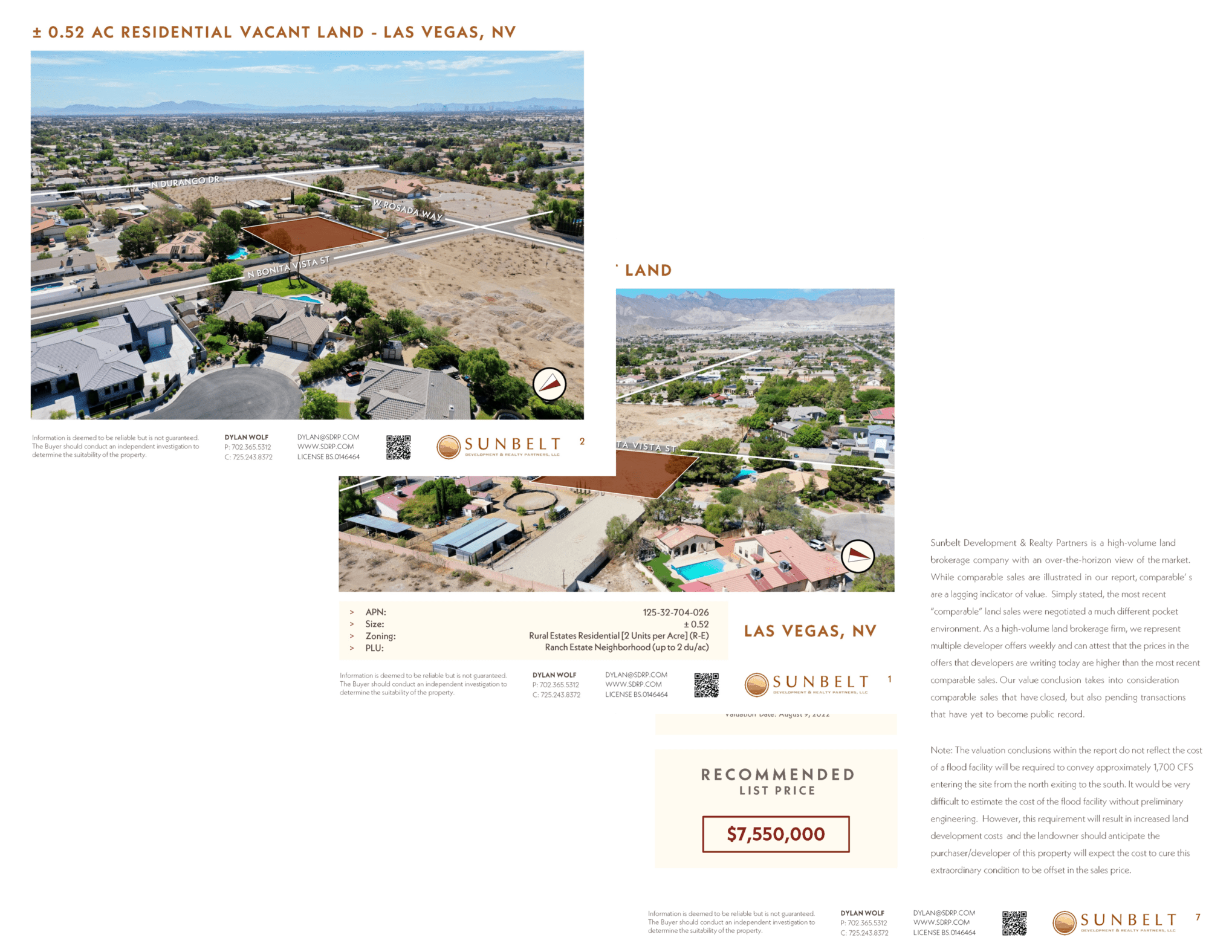

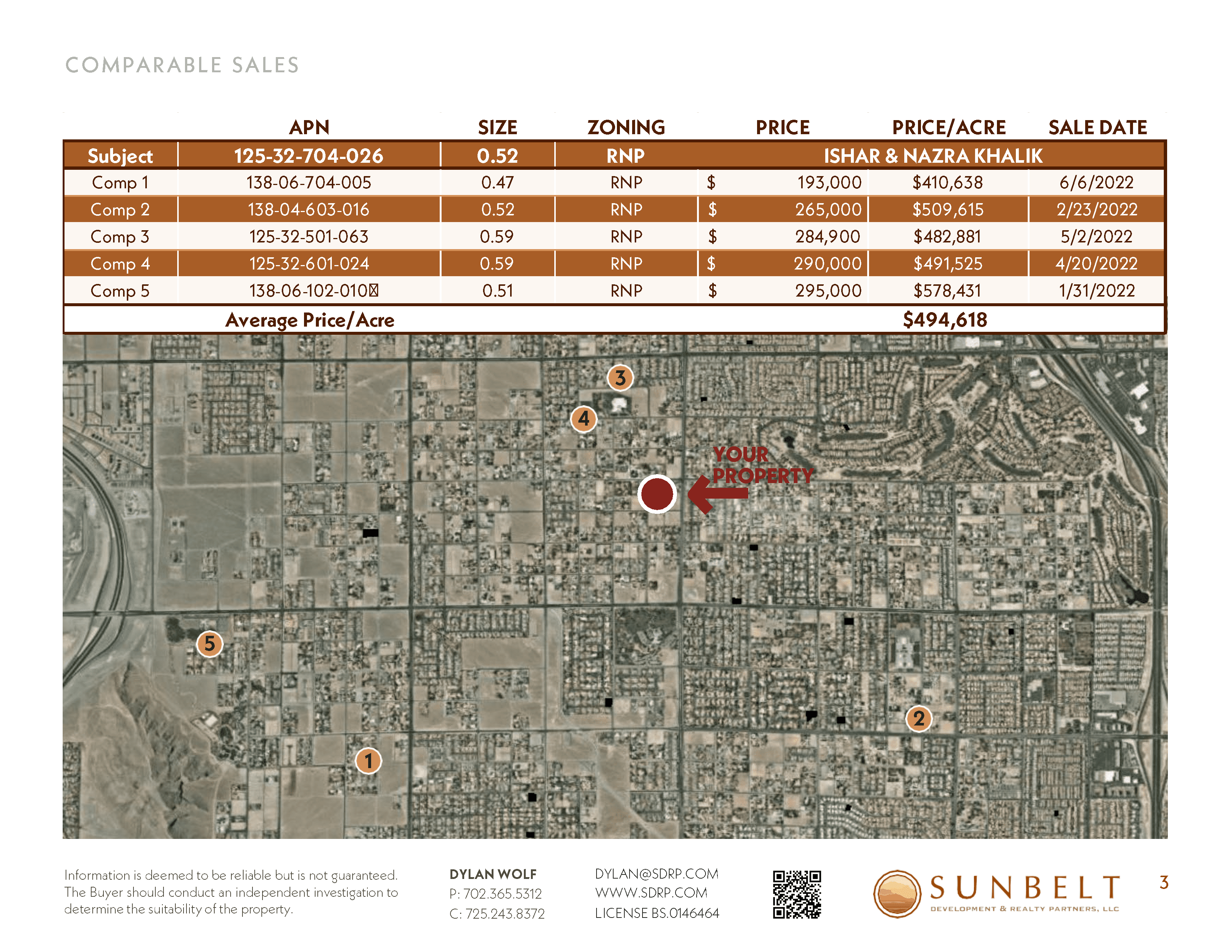

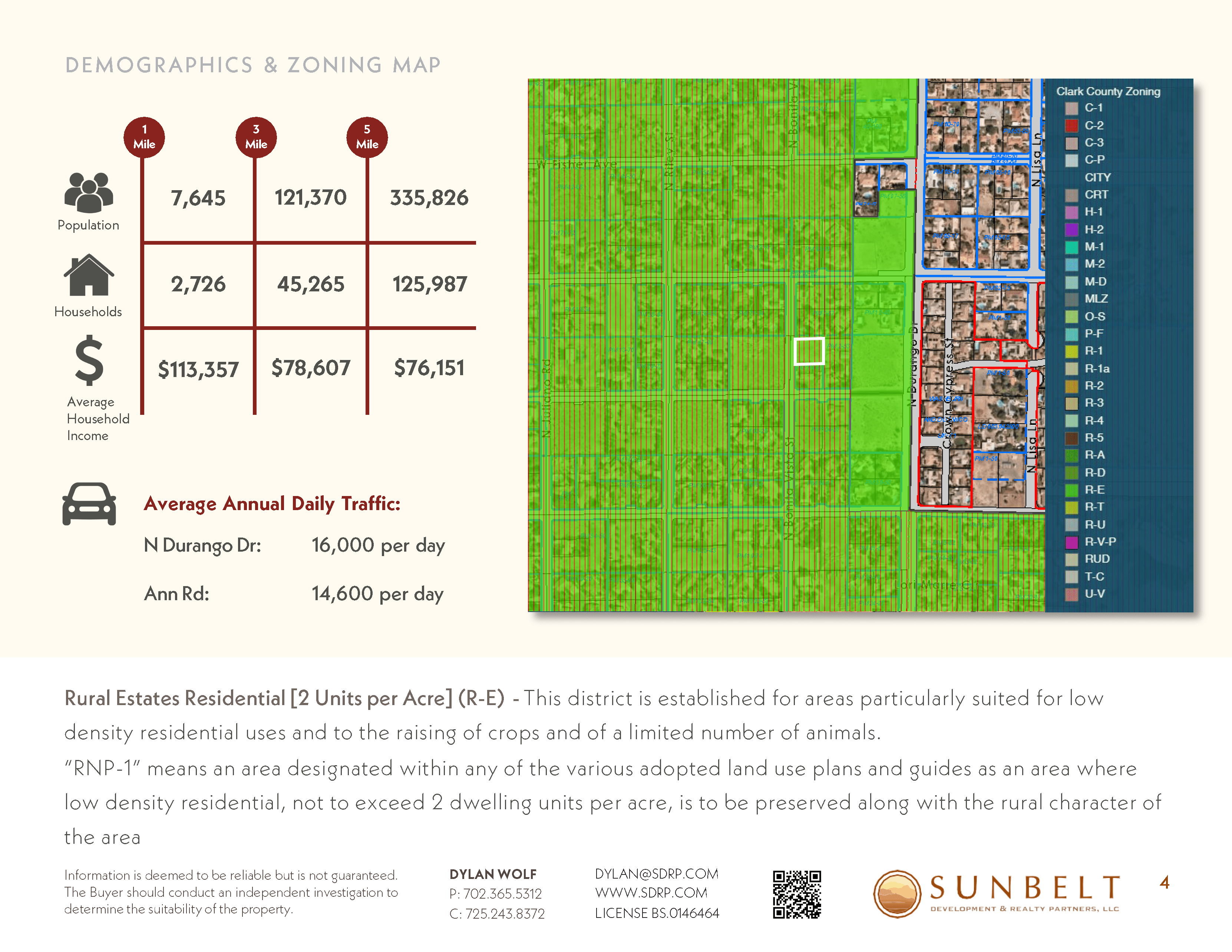

In addition to comps, a thorough BPO contains visual references and geographic comparisons to assess a property’s physical characteristics – drainage, access to utilities, topological issues, water rights, easements, etc. Well-informed submissions also provide insight into zoning, entitlements, legal issues, and the property’s sensitivity to economic conditions.

Why do you need an informed Broker Price Opinion now?

This year the Federal Reserve has raised interest rates 4 times to mitigate inflation. Today the inflation rate is still over 8%. The Federal Reserve’s goal is 2%. It is almost certain the Fed will continue to raise interest rates later this fall and again during the first quarter of 2023.

The Fed’s actions have had a predictable impact on certain areas of the real estate market in Las Vegas. Residential home sales have slowed, but people continue to move here. The population in Clark County is project to increase by 640,000 to 3.02 million by 2035, and there is a shortage of developable property.

Opportunities exist for well-informed landowners. The industrial real estate market is operating at historically high leasing rates while maintaining historically low vacancies. Residential sales have slowed, and there is still less than a year’s supply of new homes on the market while residential leasing rates remain near all-time highs.

Developers operate with a longer-term view because they require 12 – 18 months to build their properties – after they acquire fully entitled land. This means developers are purchasing land now. In August, 40 properties were sold for more than $640,000 per acre.

Taken together, our view is this – the economic slowdown is real, but temporary. Developers remain bullish about their prospects in Southern Nevada. Why? Because residential real estate prices are comparatively low, there are industrial opportunities abound and there are plentiful employment opportunities here. Las Vegas is strategically located. There is no state income tax, and developers will continue to make money in Las Vegas.